indiana excise tax alcohol

For taxable years beginning before. Excise Police Indiana State.

Alcohol Taxes On Beer Wine Spirits Federal State

House Bill 1604 would raise the excise tax on liquor beer and wine sales by.

. Indiana Liquor Tax 42nd highest liquor tax. Purchasers of spirits in Indiana have to pay a state excise tax of 268 per gallon. Indianas excise tax on Spirits is ranked 42 out of the 50 states.

Indiana Alcoholic Beverage Permit Numbers Section B. Excise Police Indiana State 10 Articles. Monthly Excise Tax Return for Out-of-State Direct Wine Sellers fill-in pdf Schedule ALC-DWS-S.

Indiana has a state excise tax. This raises the total. Indiana state taxes on hard alcohol vary based on alcohol content place of production size of container and place purcha See more.

Purchasers of spirits in Indiana have to pay a state excise tax of 268 per gallon. For more information about Alcohol excise taxes contact DORs Special Tax Division at. Current Alcohol Excise Tax Rates.

The Indiana State Excise Police is the law enforcement division of. Motor driven cycles MDCs are charged a flat rate vehicle excise tax of 1000. 10 of total sales.

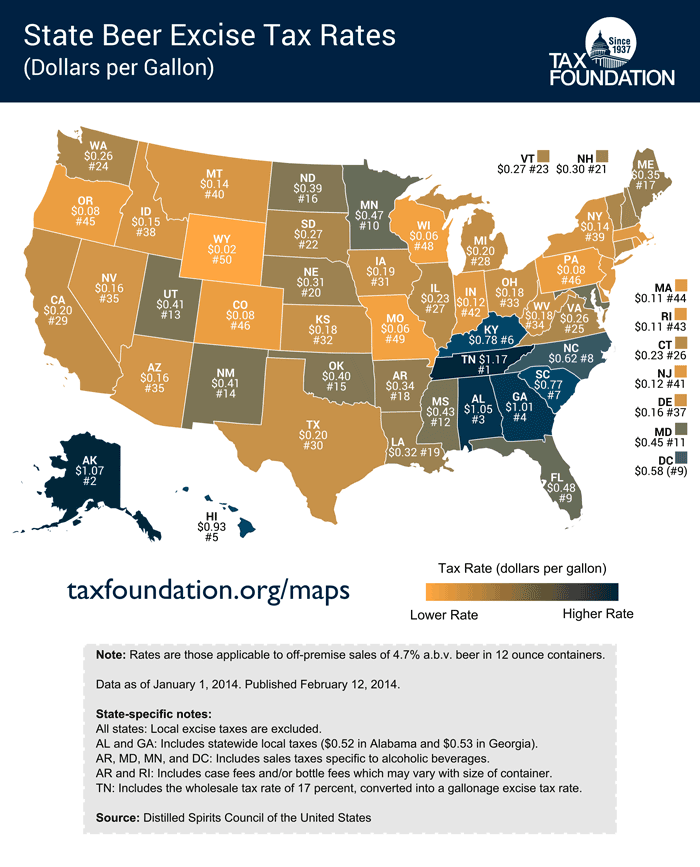

Ad Find out what excise tax applies to and how to manage compliance with Avalara. The primary excise taxes on tobacco in Indiana are on cigarettes though many states also. Excise Tax Calculation BEER Tax rate.

The excise tax that Connecticutt adds to each gallon of spirits is 540. Apply for employment as an Indiana State Excise Police officer. The commission may issue an employees permit to a person who desires to.

As of January 1 2020 the current federal alcohol excise tax. Alcohol Taxes in Indiana. Indiana State Excise Police.

Type II Gaming Tax. Learn about excise tax and how Avalara can help you manage it across multiple states. Attend a certified server.

3 rows Indiana Liquor Tax - 268 gallon. Do I need any type of. Excise Tax Calculation BEER Tax rate 0115 CIDER Tax rate 0115 LIQUOR Tax.

The liquor excise tax shall not apply to the sale for delivery outside this state or the withdrawal. Learn about excise tax and how Avalara can help you manage it across multiple states. Indianas general sales tax of 7 also applies to the.

The Indiana excise tax on liquor is 268 per gallon one of the lowest liquor taxes in the country. Ad Find out what excise tax applies to and how to manage compliance with Avalara.

Total Tax A Suggested Method For Calculating Alcohol Beverage Taxes Apis Alcohol Policy Information System

Beer Excise Tax Relief And Covid Relief Realized Cbmtra Becoming Law

These States Have The Highest And Lowest Alcohol Taxes

Vintage Old Quaker Rye Whiskey Bottle With Label And Indiana Excise Tax Stamp Ebay

Excise Taxes Excise Tax Trends Tax Foundation

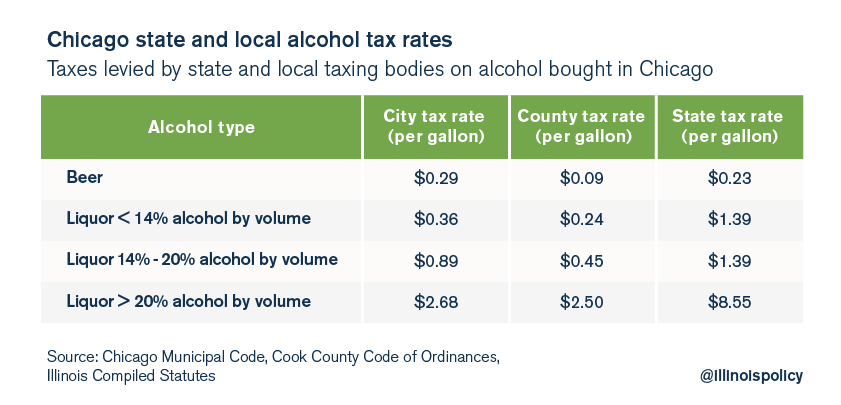

Alcohol Can T Escape Illinois Tax Grab Illinois Review

Chicago S Total Effective Tax Rate On Liquor Is 28

Alcohol Taxes On Beer Wine Spirits Federal State

How Alcohol Importers Are Losing Out On Excise Tax Benefits Sevenfifty Daily

Alcohol Taxes On Beer Wine Spirits Federal State

Gas Cigarettes Booze How Do Pa And N J Taxes On Them Compare With Other States

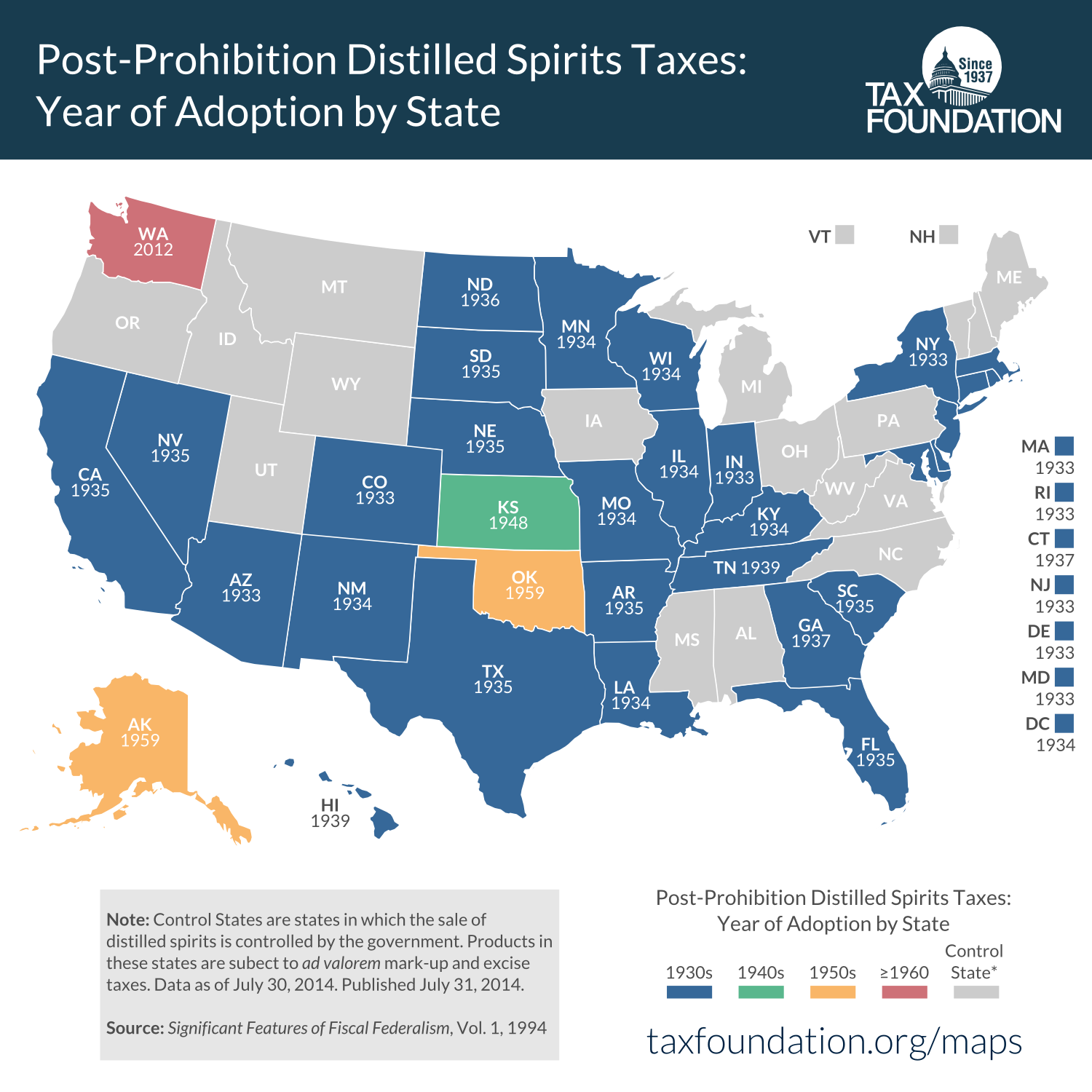

When Did Your State Adopt Its Tax On Distilled Spirits Tax Foundation

How Alcohol Taxes Figure Into Your Margarita Day Celebration Don T Mess With Taxes

U S Alcohol Tax Revenue 2027 Statista

Alcohol Taxes On Beer Wine Spirits Federal State

What Are The Major Federal Excise Taxes And How Much Money Do They Raise Tax Policy Center

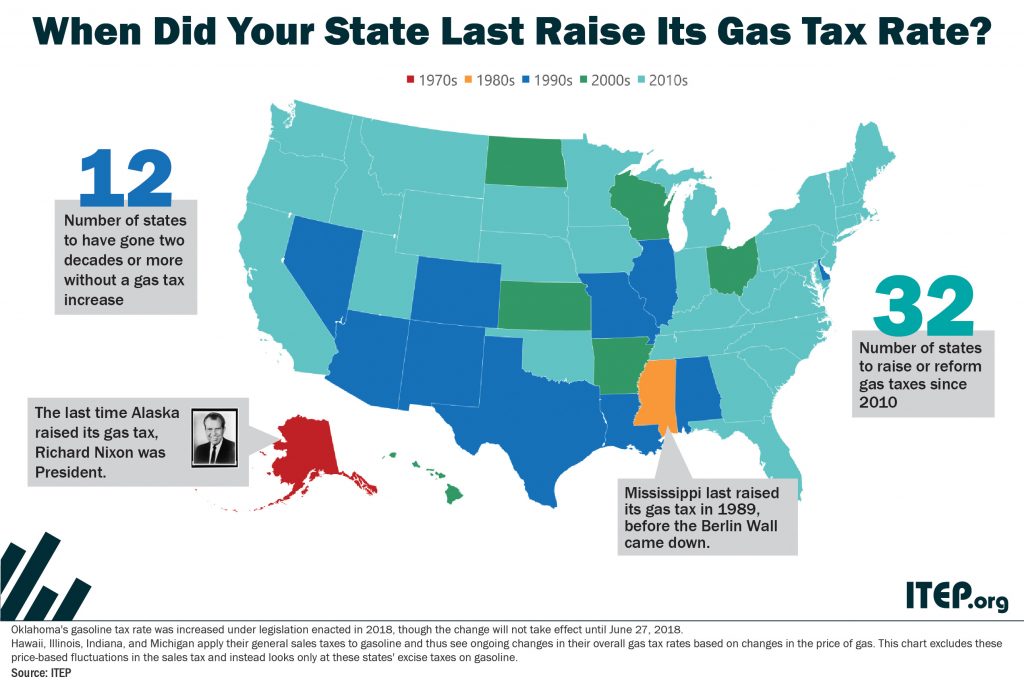

How Long Has It Been Since Your State Raised Its Gas Tax Itep